A Ukrainian Army soldier places a U.S.-made Javelin missile in a fighting position on the frontline on May 20, 2022, in Kharkiv Oblast, Ukraine. John Moore/Getty Images

Sales of anti-armor missiles projected to slow

But the tank's not dead, so look for the market to come back in a few years.

The long-predicted demise of the tank has not arrived yet, despite the continuing sales of anti-tank munitions. Armed forces will likely spend $20 billion on short-range anti-armor weapons in the next decade, according to a new report out from Forecast International.

Annual sales are expected to dip in the short term, but will likely rise again after that, with total production expected to average around 26,000, the report says.

The U.S. and Europe are working on new missiles to meet the needs of different military services. The U.S. Joint Air-to-Ground Missile program has seen several delays to its planned in-service date, but appears to be avoiding the fate of its predecessor: the cancelled Joint Common Missile program.

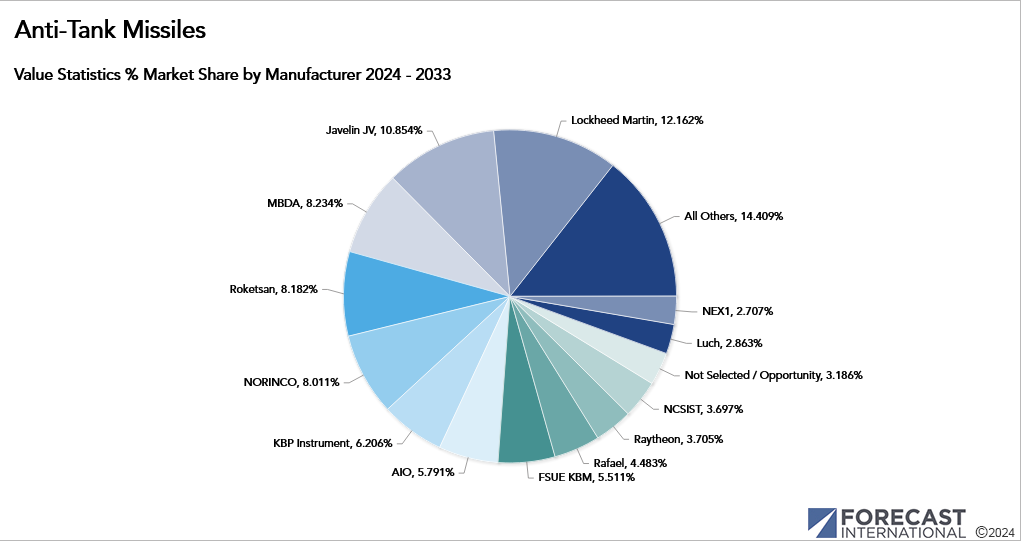

U.S. firms, such as Lockheed Martin and Raytheon are the leading players in this market, accounting for a combined 28 percent value share with the Javelin joint venture and other programs. Europe’s position has declined to around a 19 percent value share but is expected to improve with the development of new systems.

Europe is moving to develop new anti-armor missiles and hold on to its share of this market. The MMP (Akeron MP) and MLP programs aim to replace the MILAN and HOT, respectively. MBDA is working to interest more European companies in participating in these programs.

A trend to watch out for: anti-ship missiles have begun to become multi-purpose weapons that can engage a wider variety of targets. Could anti-armor missiles be next?